Welcome back and happy Tuesday. If you didn’t know – today is also tax day! Such fun. We are fortunate enough to get the last of our K-1s out the door this morning. Tax season never seems to be an easy one. 2022 was the last year of 100% bonus depreciation which means the calculus for tax losses changes in 2023 and beyond. This past year we had some properties that generated an 80% tax loss for our investors! That’s a nice way to start any investment – with massive potential tax savings. However, those hefty tax losses start to decrease as the 2017 tax cuts begin to sunset. Not the best timing, in my opinion, given the weakness in the economy, but it is what it is.

Last week was a fairly tame week on the economic front. I think the biggest challenge that I see right now is continued fear. The media does an excellent job of pointing out and highlighting some pretty dire scenarios. Not to say there aren’t legitimate reasons to be concerned. There is certainly a heightened sense of uncertainty. The question I always ask myself during these times is this…who, if anyone, is acting and moving forward during a time like this? Is it just a time to sit on the sidelines? I’ve found two interesting trends.

First, the less sophisticated investor is taking advantage of discounts in asset prices to make some acquisitions – real estate, stocks, etc. But most of them are acting based on their gut instinct. They trust their sense of opportunity to steer them during times of uncertainty. Then there’s the vast majority of folks who follow the tide. Certainly, there’s nothing wrong with following the majority, and in some cases that majority can also actually “make” the market. In other words, if the majority sits on the sidelines that can actually perpetuate a downturn. Right now, for the most part, it’s the middle-class investor – the one who thinks they know more than they do – who is panicking.

And then at the opposite end of the less sophisticated investor are the ultra-high net worth investors. What are they doing right now? Well, I find it interesting that most of them are investing. Investing in companies that are struggling, investing in assets that are selling at a discount, and investing in new housing/apartment projects. These folks have seen this cycle before – and they know that when something is “out of favor” with the majority (as new development is currently because many people think there is too much inventory and the economy is going to crash), that’s usually a good time to invest and get an outsize return.

I say all of this to encourage you to do your own thinking. And I hope the data that I provide here on this CEO blog can help with that. It’s a somewhat tricky balance between data and sentiment. Sometimes sentiment can MAKE data in the short run. But as Warren Buffett would say – follow the cash flow. Are we in an environment where our core business – leasing apartments – is still strong? Absolutely. Are we still ahead of the average when it comes to growth rates? Yes. Do we think inflation and high-interest rates will stay for 5 years? No. Does it matter where you invest geographically? Yes. Follow the growth and stick with the data. I still think there are good opportunities to invest right now.

Inflation Delay

It seems that everyone just woke up and suddenly realized we’re headed for a recession. I’m not sure this is too terribly surprising given the pace of Fed rate hikes and their determination to crush inflation. I think it’s interesting that the news cycle can often be very different from reality. Next week I want to dig into the hype vs reality of the reserve currency discussion, but for now let’s talk about inflation. The CPI is a major measure that the Fed uses for tracking inflation. Housing costs have been one of the biggest factors affecting CPI recently due to the large increase in housing costs. Rents a component of that housing cost.

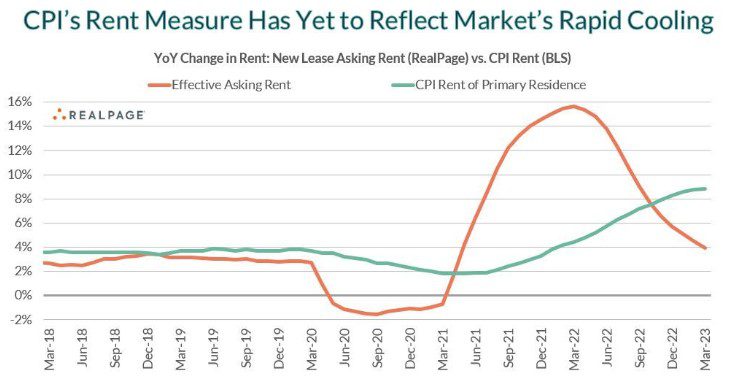

But here’s an interesting twist – timing is everything. If you look at the graph below, compliments of my friends at RealPage, you’ll notice that effective asking rent has been on a downward trend for a year now. A solid year of slowing growth. At the same time, the CPI has been increasing. We’re about 6-12 months delayed in seeing the results of the falling rental rates. You can also see that the rental rates are beginning to bottom out, as expected. Long-term average prior to the pandemic as 2-3%. We’ve always underwritten at 3%. And interestingly enough, even during the pandemic when the average was slightly negative, we continued to grow our rents without much abatement because our properties had really strong fundamentals (location, value, basis, etc).

Leadership Meeting

One of the highlights of last week was our REM leadership meeting. Being a 100% remote team, I’m realizing the importance of getting us all together once in a while. And it’s a lot of fun as we tackle the myriad of issues at REM. This was our second time this year to take a day to work ON the business. We recapped some of the key points from our last meeting where we rolled out the EOS program. We hired our “integrator” and are making progress toward building out our accountability chart. We also set some pretty big goals for 2Q2023 – more on that next week!

I also took the opportunity to challenge my team on what true leadership looks like. It’s something that I’m always working on (none of us have ever “arrived”) but I think I’ve gained some wisdom over my years in business. We have a talented, hard-working team, but without good leadership, we’ll only be average.

I believe there are three primary components of leadership here at REM. The most basic component we call GSD – getting stuff done. You have to be an expert at your craft – organized, disciplined, knowledgeable, hardworking, etc. The next component is communication. You can be the most productive person in the company but without effective communication, you’re missing a critical component of leadership. And at the core of it all is 100% personal responsibility. Not just for your job duties (GSD) or being a good communicator – but taking things to the next level and realizing YOU ARE A LEADER. It’s not a duty, it’s not a title, it’s not a role – it’s who you are. You think like a leader. Leaders take 100% responsibility for their role as leaders.

OK, enough about that – time to go get some leasing done. We’re in the middle of leasing season. We’re making great progress. We just rolled all of our property websites to a new platform designed/built by our total rockstar in-house marketing team! Can’t wait to see the increase in leads, the increased visibility on traffic, and better control of our most important marketing “face” – our website and social media. Tie that in with some new hires who bring excellent experience in value-add renovations, and we’re getting there. Persistence wins the game!