For all you dads out there, happy belated Fathers Day. I hope you had a great weekend! In the spirit of corny dad jokes, I had to post the one above. I thought it was pretty clever – especially since a money tree would come in handy about now. Yesterday was also a recently enacted national holiday celebrating the end of slavery in the United States. While I don’t support the politicization of this or any other good cause, I think most of it’s origins were well-intentioned and meaningful. Given that more people died in the Civil War than any other war, it seems appropriate to both commemorate and celebrate one of the major reasons of that war. My hope is that rather than using this holiday to complain about the past, we celebrate the sacrifice and achievements of those who made it possible. We have much to be thankful for.

Staying In The Game

I do want to chat about interest rates, inflation, and some deal highlights – but before we go there, I wanted to share a little about my business philosophy in relation to the uncertainty we currently face. From time to time, I like to share some of my vision for REM so that you can get to know us better. My goal is that the more you get to know us, the better informed your decision to invest with us will be. My hope is that our philosophy and culture align with yours. So here are my thoughts…

There will be those who come out of this downturn having taken no risk and being proud of staying off the field (the spectators). There will be those who come out of this claiming credit for the hard work of others (the sidelines). And there will be winners and losers (the players). No one wins all the time, no one. No one becomes a star by being successful all the time. Being a player means losing sometimes. Being a great player means winning most of the time in the long run. If you like sports history, pick up a book on the story of Michael Jordan. He faced unbelievable obstacles but was persistent and never gave up. Great story about perseverance.

He is among the players who finished the task and achieved the goal. These are players in any field that are well-trained and well-prepared, they stay focused in the midst of challenges, and they persevere in spite of the criticism, the questions, and the setbacks. We are currently facing times like these in commercial real estate. Some folks will hand in the keys and call it quits. Others will realize they weren’t quite prepared enough and have to leave the field. And many who will press forward, solve for tomorrow, and be successful. Our goal is to press forward with fervent determination – focused on the goal of both protecting and growing our investments.

As you know we don’t really subscribe to the fake smiles and the always good news – or the always bad news. I like to focus on actionable reality. What’s happening and how are we navigating our challenges? This is who we are. I told my team yesterday at our weekly leadership meeting that I’m more encouraged about our team than I’ve ever been. We’re all on the same page about being realistic and positive. Having the skill and experience to know what’s not working and the courage to take action in a positive way and keep motivated. It’s taken a while to get here but it’s really exciting to see their success and our progress. We are persevering!

Inflation Down, Interest Rates Flat, What’s Next?

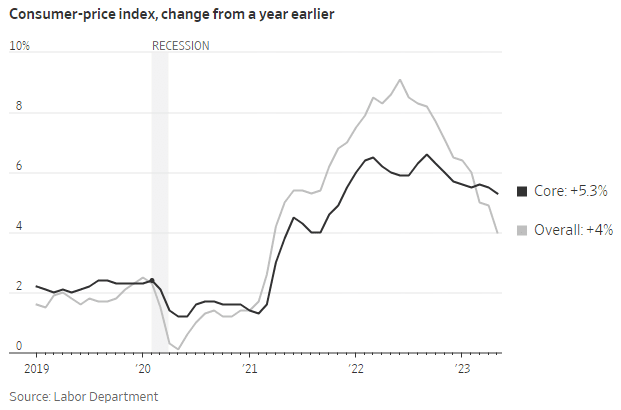

With that said, let’s dive into some meaty news from last week. Two headlines. Inflation dropped quite a bit to 4% – a nice continued weakening showing the downward pressure on inflation continues. It’s also encouraging in that a large piece of that number includes still inflated housing numbers – which as I mentioned a couple of weeks back will continue to drop since it’s a 12-month lag. So again, all other things being equal, we’ll continue to see inflation drop.

I found it fascinating that with this continued fairly sharp downturn in inflation, writers were quick to point out that “we’re still not at the Fed’s target inflation rate” as if the drama was going to end too soon. I’m not making any predictions but if the upswing looks anything like the downswing, we’ve got about 9 months left until it’s game over for inflation. At this point, I’m more concerned about what the Fed does to fight fantom inflation and how that could really ruin the job market.

The Federal Reserve officials have been closely monitoring the prices for labor-intensive services while excluding food, energy, goods, and housing prices. They are hoping to identify if the wage pressures from the strong labor market are affecting the consumer prices. According to J.P. Morgan economist Michael Feroli, this category rose 0.24% in May, which is similar to its average in the two decades before the pandemic.

Officials have unanimously decided to maintain the current federal-funds rate benchmark range of 5% to 5.25%. This is a wise move as increasing the short-term rate now would cause it to reach a 22-year high, which could lead to potential issues. Policymakers are carefully considering the lack of substantial inflation and the cooling of economic activity, while also balancing the risks of rapid increases from last year and recent banking strains. These factors could impede growth and the labor market more than anticipated. While there hasn’t been a final decision to increase rates every other meeting, Fed Chairman Powell has suggested that it may be beneficial to spread out the Fed’s rate increases, given their proximity to the final destination for rates.

The job market appears to be strong still but the cost of living has increased at a pace that will keep the lid on growth. The tech market is adjusting to the new normal. The real estate market is adjusting to the new normal. Another 6-12 months at 5% and I think we’re going to see opportunity in the multifamily space as long as the Fed doesn’t go too far with the rate hikes and really wipe out the economy (and job growth). TBD.

Onsite Focus – Audubon and St Pete

We kicked off St Pete with the required shovel sand throwing contest! Thanks to everyone for making it a great event.

Audubon Crest in Oakwood, GA is a great testament to the importance of perseverance. We purchased Audubon in the middle of the pandemic, had challenges with leasing, took over management a year later, finally got it up and running, and it now kicks off 10% in monthly distributions. It’s also just about doubled in value since we bought it. I won’t claim credit for some of the value upside – but the point is that we kept at it and now we’ve got a beautiful asset in a prime location generating great cash returns for our investors.

That’s all for now! Thanks for reading and have a great week!