Welcome back! As we head into the last full week of January 2024, there are plenty of things in progress.

TAXES

Tax season is upon us! In less than 2 months our K-1s will need to be complete so we’re wrapping up December financials to get over to our CPA by the end of the month. That will ensure we have our K-1s out on time (by March 15). In the past we’ve run into challenges with staffing shortages and financial statement completion but this year things are looking good! I know many of you depend on the timely receipt of your K-1 and this year we don’t plan to disappoint. If you haven’t logged into your investor portal recently please do so. All of the K-1s will be posted in the portal and you’ll get an email notification.

With bonus depreciation dropping to 60% this year, it will be more difficult to offset real estate income with depreciation losses. However, on January 19, just a few days ago, the House Ways and Means Committee overwhelmingly approved the Tax Relief for American Families and Workers Act of 2024 by a 40-3 vote. The bill provides for increases in the child tax credit, delays the requirement to deduct research and experimentation expenditures over a five-year period, extends 100-percent bonus depreciation through 2025, and increases the Code Sec. 179 deduction limitation, among other business-friendly provisions.

Many of the important provisions in the bill will apply to past tax years. The aim is to have the bill signed by President Biden before the 2023 tax filing season begins. However, it is uncertain whether this is feasible given the House and Senate schedules in January. Nonetheless, the bill has bipartisan support in both chambers of Congress. Even if the bill is passed before the filing season starts, changes that are applied retroactively to the 2023 tax season could cause problems for the IRS and result in a delay in processing returns.

RENT GROWTH

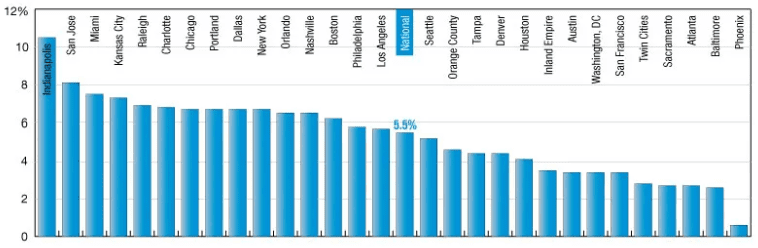

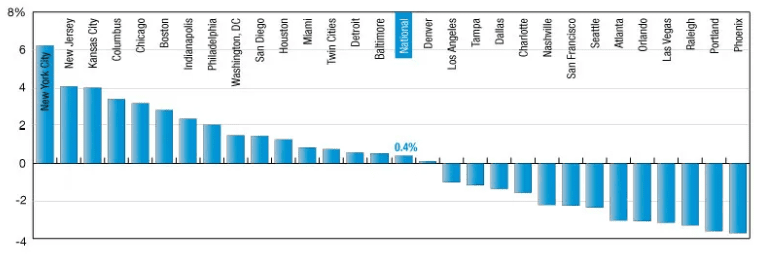

We started last year with a nearly 6% rent growth average nationwide. Some of the leaders in that sector included Charlotte, Dallas, and Orlando. During 2023 rent growth fell consistently to 0.4% in December 2023. Some of the laggards included Dallas, Orland, Charlotte, and Orlando. With assets in each of these markets, we’ve felt the effect of this across our portfolio as we’ve struggled to achieve our expected rent growth. We underwrite our deals to the long term average of 3%. Having gone from one extreme to the other over the past 12 months, we’re now at the low end of that scale. I’m not sure how long we’ll be in this downturn, but we can be fairly certain that at some point rent growth will return to the mean (or above).

Here’s where we started 2023…

And here’s where we’re at today…

INSURANCE

We’ve succeeded in renewing about a quarter of our portfolio with admitted carriers at much lower rates. Admitted carriers are the larger, more well-known carriers who are typically stricter with their underwriting criteria but also tend to offer lower rates. Excess carriers are typically spinoffs of larger carriers and/or carriers looking to fill the gap in the market left by the admitted carriers who don’t cover riskier assets. As we continue to push forward in this space, it does appear that the overall market has softened a little (i.e. pricing has come down somewhat) from last year (one of the worst on record). Part of this is due to the lack of major fire and flood damage. Obviously things can change quickly when it comes to natural disasters.

Thankfully admitted carriers also have lower deductibles (i.e. $25k vs $250k) and better coverage so we prefer to partner with them if possible. We’ve also increased our average total loss limit from $115 per square foot to $135 per square foot. This is a calculation of how much coverage we want to have based on a total loss scenario. A higher price per square foot calculation is better because it protects us against the higher cost of construction should we need it. Aside from the burn building in San Antonio, we’ve had no other major losses. I’m also glad to say that thus far we’ve seen no claims and minimal damage from the latest cold weather that spread across the country last week. Our maintenance teams were vigilant to prevent and address issues as they came up.

That’s all for now! Have a great week!